While budgets are a standard structure utilized by various organizations, school budgets are uniquely distinguishable. Curious about how to develop accurate school budgets and what sets them apart?

Here are five frequently asked questions about school budget development – ANSWERED.

1. What Is a School Budget?

A school budget development process is comprised of revenue and expenditure monitoring. The process entails allocating funds to specific categories to support school programs and district operations for the upcoming year. The process also has layers because public schools are governmental agencies.

Therefore, schools must abide by timelines and regulations specified by the local, state, and federal government levels. After meeting these mandates, schools are left with competing priorities, such as deciding whether to use the funding to meet government relations versus support school programs.

Unfortunately, the government doesn’t fund many of these mandates, which further complicates this issue. As a result, schools must fund regulations linked to building maintenance, union contracts, special education, and other areas. Since these spheres aren’t fully funded, local funding sources provide money to compensate for funding deficits.

However, there is limited availability of funding to pay for these programs. Schools must have difficult discussions at the departmental level and make challenging decisions to determine which district priorities will be funded or minimized for the upcoming year. Also, if the need arises to decrease allocations to targeted areas, schools must carefully consider how programs and students may be affected.

Overall, the highly laborious budget development process adheres to an established procedure across all departments to:

- Comply with governmental regulations

- Present a budget to its constituents that justifies the collection and disbursement of public funds to support programs and district operations

2. How Do Schools Obtain Funding?

Generally, schools receive funding through three sources: local, state, and federal government levels. The local funding source is the school taxes paid by its community. Through utilizing education formulas based on reported student data, state funding is apportioned for each district. Finally, federal funding is provided by federal programs and grants, including the Individuals with Disabilities Education Act (IDEA), Title I, Title III, Title IV, special education programs and grants, and more.

However, these revenue sources may fluctuate from year to year, particularly for federal and state allocations. When allocating these funds, it’s best to consider how a district would continue providing the proper personnel or programs if the revenue decreases.

When schools receive one-time funding, such as through the CARES Act, this is especially important. If leaders decide to use this funding to purchase personnel, they must identify another funding source to pay for personnel in future years.

Drawing upon my years of special education experience, I would recommend using only a fourth to half of the allocated funds for this purpose. This way, if funding decreases in future years, leaders can continue to fund the position. Also, schools will lose their allocations for each school year unless they spend them entirely.

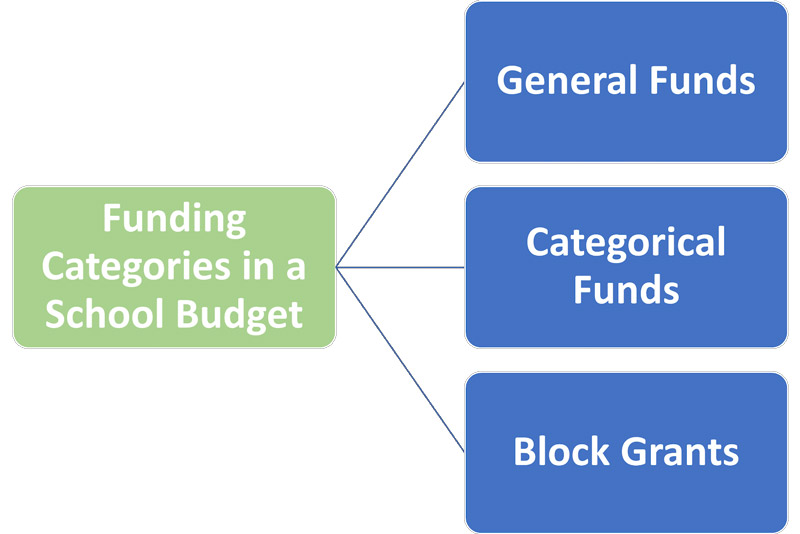

3. What Are the Funding Categories in a School Budget?

A school budget is divided into distinct funding categories. Since these funding sources are separate, each source features a unique set of rules and regulations. Throughout the year, departmental directors disperse money from all three categories. Below are a school budget’s common funding categories: general funds, categorical funds, and block grants.

- General Funds

- Unrestricted funds

- May be used for any budgeted purpose

- Accounts for the majority of an entity’s revenues and expenditures

- Categorical Funds

- Designated to be used for specific categories

- Restricted for use by particular programs, such as IDEA, Transportation, etc.

- Block Grants

- A sizeable monetary sum provided with only general requirements indicating how the grant will be spent

- Funding designated for a specific purpose, such as Title 1

- Less prescriptive than categorical funding

4. What is the Budget Development Process?

Through my previous role as a School Principal, and my current role leading Therapy Source’s Compliance Division, I’ve participated numerous times in the budget development process. Generally, the process follows these steps:

- Early Fall

- The school district begins budget discussions, which include a review of:

- Existing programs

- Previous and current budget expenditures

- District priorities

- The budget development process

- The school district begins budget discussions, which include a review of:

- Mid-Winter to Early Spring

- The school district begins preliminary budget development, which includes:

- Anticipated costs of new initiatives

- Reductions to existing programs

- Salary and benefit estimates based on state and federal allocations

- The school district begins preliminary budget development, which includes:

- Late Spring

- To the school board, the school district presents the budget for final review.

- Public hearings usually occur to receive input before adopting the district budget

- June 30

- Deadline for the final budget’s passage for the new school year

5. What Are the Steps to Develop a Successful Special Education Budget?

To develop a budget that accurately represents future expenditures, administrators must remain knowledgeable about funding source regulations. Also, they should be aware of how well the current budget meets the students’ and programs’ needs.

Beyond the information provided by the Business Department, the leader should conduct a needs assessment of their department. This evaluation requires gathering input from staff, parents, and external agencies that are currently servicing students.

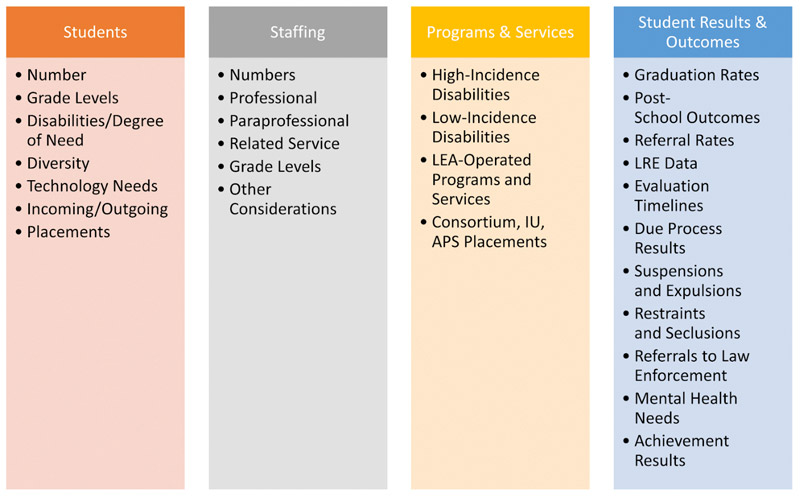

The chart below, featured in a “2019 Education Leader” publication of the Pennsylvania Training and Technical Assistance Network (PaTTAN), provides a comprehensive guide for assessment conduction. The diagram also presents a detailed outline of the stakeholders’ areas to address while formulating a budget.

Although this analysis may seem time-consuming, it provides the director with the necessary information to enact sound decisions for budget development and revisions. The guide also justifies allocating funds for specific line items, which is generally required for submission to the Business Office.

Based on my 30+ years of pediatric therapeutic services and special education experience, I would highly recommend that departmental reviews occur throughout the school year. This way, the budget will remain a fluid document that consistently accurately reflects current needs.

Follow the Path Towards School Budget Success!

A comprehensive budget drives and supports program development. The data acquired from the needs assessment and previous budgets’ review are essential factors of the budget’s success. Ultimately, this data is necessary to make informed decisions regarding which areas receive funding–and which don’t.

Finally, administrators must be well-informed about regulations attached to the funding streams. Such awareness allows a leader to use revenue sources to effectively fund multiple programs. It also enables administrators to proactively address the needs of all students–even those who transfer into the district with substantial needs.